Understanding Crypto Bridging: A Comprehensive Guide

What is Crypto Bridging?

Crypto bridging is a technology that allows the transfer of assets and data between different blockchains. This process enhances interoperability within the blockchain ecosystem. Essentially, crypto bridging acts as a digital bridge, enabling users to move their digital assets across various platforms. This capability is crucial for users who want to take advantage of the unique features of different blockchains without being limited to one.

As the cryptocurrency landscape evolves, users often need to transfer assets to access various financial services and opportunities.

The mechanics of crypto bridging involve locking tokens on the source blockchain and issuing equivalent tokens on the destination blockchain. While this process is efficient, it can be complex and may come with challenges like high fees, slow transaction times, and security risks.

For example, a study revealed that in 2022, around $2 billion worth of crypto was stolen across 13 attacks on blockchain bridges. This highlights the importance of choosing reliable bridging solutions.

How Crypto Bridging Works

At its core, crypto bridging functions as a digital bridge, allowing users to move assets seamlessly from one blockchain to another. This capability is essential for users who want to leverage the unique features of various blockchains without being confined to a single ecosystem.

For instance, a user can take Bitcoin, which is typically limited to its native blockchain, and participate in Ethereum's decentralized finance (DeFi) ecosystem through representations like Wrapped Bitcoin (WBTC).

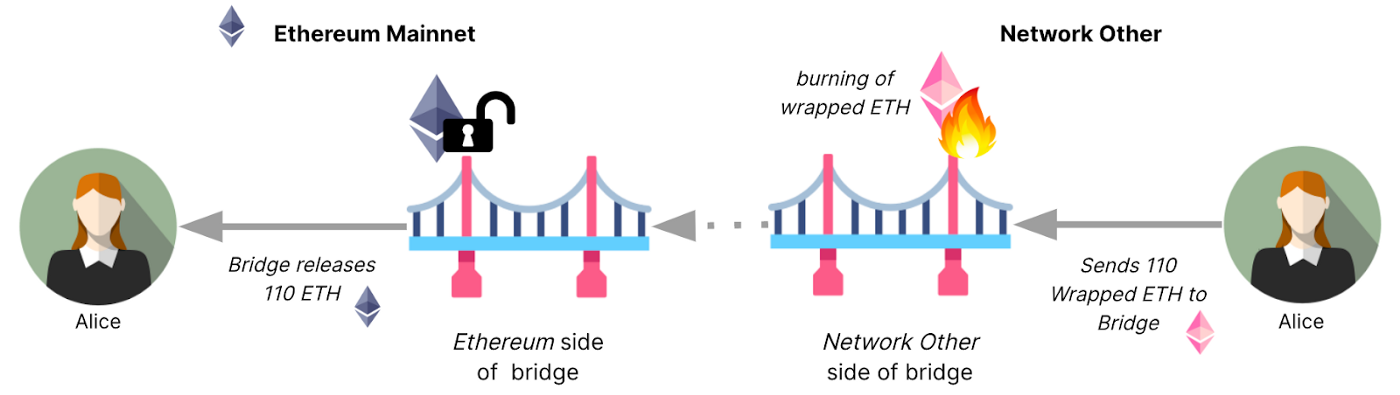

The mechanics of crypto bridging involve several steps. When a user wants to transfer assets, the original tokens are locked on the source blockchain, and equivalent tokens are issued on the destination blockchain. This process does not physically move the assets; instead, it creates a synthetic version of the asset on the new chain. This method is crucial for maintaining the integrity and security of the assets involved.

There are different types of crypto bridges, including centralized, decentralized, and federated bridges. Centralized bridges, like WBTC, are efficient but require trust in a single entity, while decentralized bridges, operate without a central authority, offering higher security and user control.

Benefits of Crypto Bridging

Crypto bridging enhances the interoperability of blockchain networks, allowing for the seamless transfer of assets and data across different platforms. This capability is essential in today's decentralized finance (DeFi) landscape, where users often need to move their digital assets between various blockchains to access diverse financial services and opportunities. By acting as a digital bridge, crypto bridging connects isolated blockchains, enabling users to leverage the unique features of each network without being confined to a single ecosystem.

One of the primary benefits of crypto bridging is its ability to enhance liquidity. Users can transfer assets like Bitcoin to participate in Ethereum's DeFi ecosystem through representations such as Wrapped Bitcoin (WBTC), gaining access to a broader range of financial products. This democratization of access is crucial for fostering innovation and collaboration among different blockchain projects, ultimately leading to a more interconnected digital economy.

Challenges and Risks in Crypto Bridging

The bridging process can be complex and costly. Users often face long wait times and high fees, which can hinder trading opportunities. In 2023, around 5% of all decentralized exchange (DEX) volume was traded through bridges, indicating their growing importance in decentralized finance (DeFi).

However, the complexity of the bridging process can lead to frustration and discourage participation in cross-chain trading. For example, most bridges only support specific tokens, such as wrapped ETH (WETH) or stablecoins, necessitating conversions that can incur additional costs and time delays.

Bridging Funds with thirdweb's Universal Bridge

Crypto bridging is a technology that enables the transfer of assets and data between different blockchains, enhancing interoperability. At its core, crypto bridging lets you interact with multiple chains, transferring tokens from one to the other.

This capability is particularly crucial in the decentralized finance (DeFi) space, where users want to take advantage of multiple chains with different functionalities.

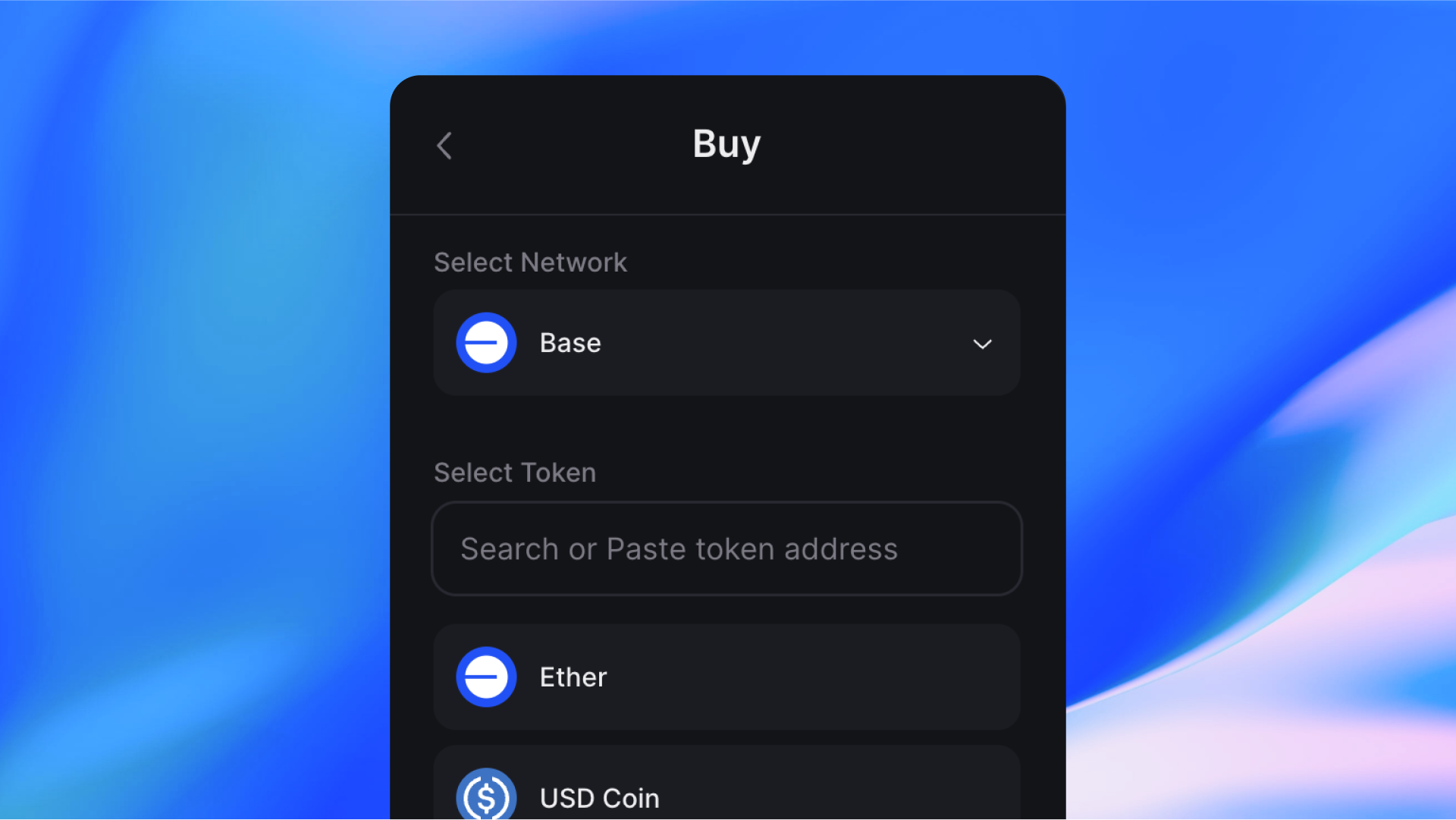

The thirdweb Universal Bridge simplifies this process, letting users bridge funds seamlessly no matter which chain their on or which token they are using. This makes bridging–as well as onramping & swapping—more accessible for those who aren't crypto native.

Universal Bridge Use Cases

The universal bridge is not just about bridging, it's an all-in-one web3 payment gateway with powerful functionalities:

- Onramp funds - using credit cards

- Swap any token on any EVM chain

- Bridge automatically and behind-the-scenes

To learn more about the specifics, check out the Universal Bridge technical documentation.

Apps that benefit from the Universal Bridge

- Games that rely on in-game tokens across multiple chains

- DEXs needing in-app onramps with web2 and web3 payment methods.

- Social apps looking to add tipping or other paid functionality to their application.

- Non-profits accepting donations in crypto

- And much much more

Whichever type of app you're building, and whatever type of developer you are, Universal Bridge is the easiest way for users to buy, bridge & swap in your app — for any audience, in any token, on any EVM.