What is Polymarket & How does it work?

Prediction markets, platforms where people can trade on the outcomes of future events, have a history that goes back to the 1980s. They work on the idea that the collective opinion of many people can be more accurate than that of a single expert. For example, these markets have been used to predict election results, economic trends, and even entertainment outcomes.

In the early 2000s with platforms like Intrade and Betfair rose in popularity due to their advantages over traditional forecasting methods: simply gathering information from many participants led to better predictions. Now, these same prediction markets have entered the crypto sphere.

You may have already heard of crypto prediction markets like PredictIt or Polymarket. But if you haven’t let’s dive in to what they are and how they differ from traditional methods.

What is a Prediction Market in crypto?

Prediction markets in crypto come in two main types: centralized and decentralized prediction markets.

Centralized crypto prediction markets like PredictIt offer structured environments where users can trade shares based on political events while following specific regulations.

Then decentralized platforms like Polymarket allow users to bet on world events using cryptocurrency without central authority interference.

What is Polymarket?

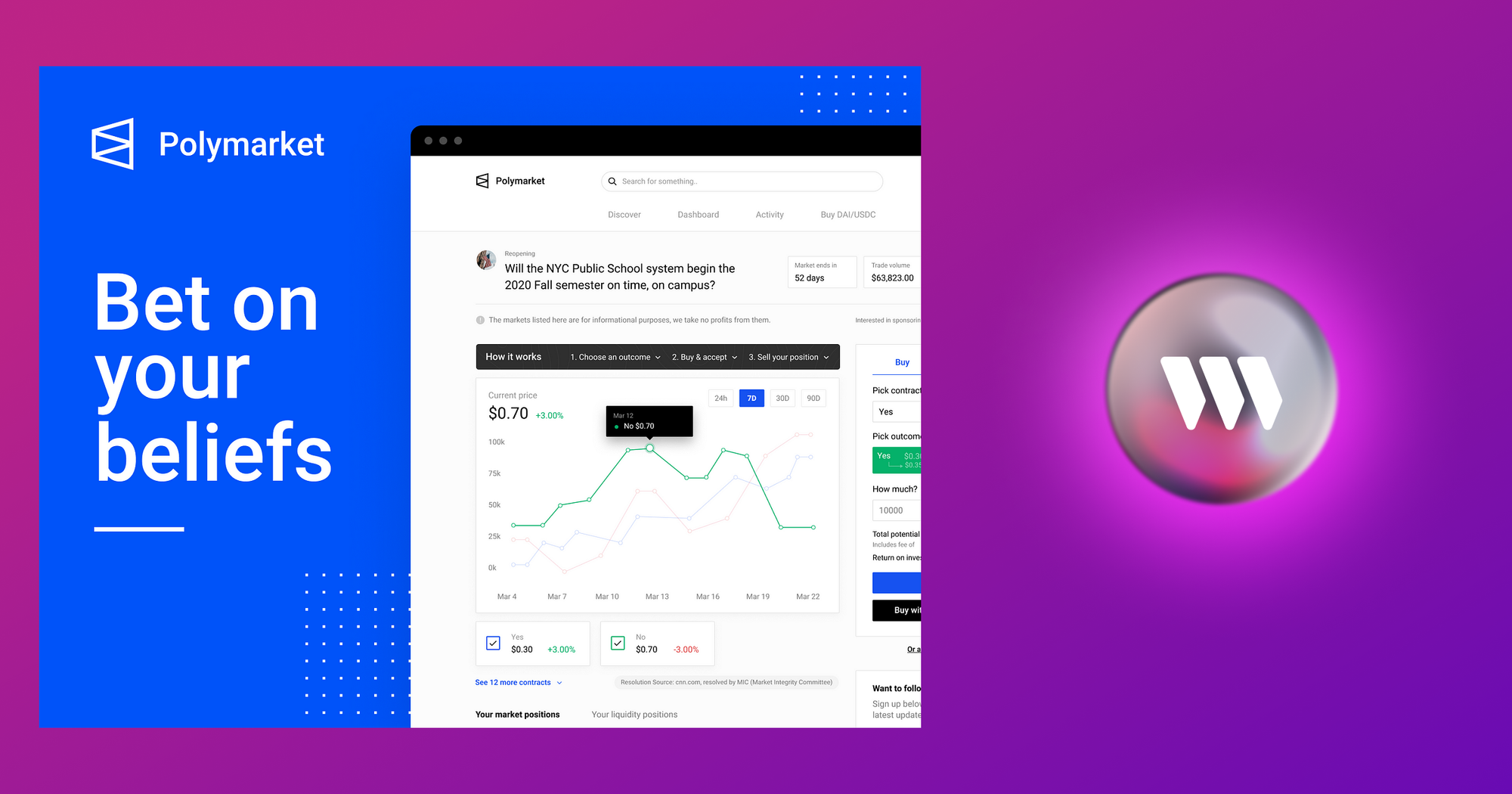

Put simply, Polymarket is a decentralized crypto prediction market. Launched in 2020 by Shayne Coplan, it allows users to bet on the outcomes of real-world events, such as elections or sports games.

As of May 2024, Polymarket raised $70 million in funding to build the future of onchain prediction markets, and has built its platform on the Polygon network – a leading blockchain for consumer apps.

Who is Polymarket for?

Polymarket is for people who want to bet on the outcome of real world events using the crypto ecosystem. Since it is decentralized, it offers more transparency and trust than traditional prediction markets which may have a centralized owner or manager.

You could bet on the outcome of a sports game such as soccer, American football, baseball or similar. You can even bet on the outcome of elections in different countries. If there are enough people interested, you can bet on the outcome of anything!

Since the process gathers diverse opinions from participants—often called "the wisdom of the crowd"—it can lead to more accurate predictions compared to traditional forecasting methods. This means Polymarket is also for people who want to track odds more accurately.

How does Polymarket work?

Polymarket works by allowing participants—traders, market makers, and observers—to buy and sell contracts based on expected outcomes. Think of each share like a representation of the probability that event occurs.

For example, let's say we're betting on the question “Will ETH hit $5k in 2025?”. In this case, we'd have the option to buy shares for each possible outcome: “Yes” and “No.

Each share of “Yes” and “No” will have a price between $0.01 and $1 in USDC. The sum of both options equals $1 in USDC. This means the trade is collateralized no matter which outcome is realized. If ETH hits $5k in 2024, every “Yes” share becomes worth $1 and every “No” share becomes worth nothing. And if it doesn't hit $5k, the "No" shares would become worth $1.

This guarantees a balanced market that relies on the value users put down.

How Polymarket works for individual users

If you want to bet on Polymarket, you will need a web3 wallet and USDC. All you need to do is choose something to bet on, connect your wallet, approve the USDC, and wait and see what happens. Polymarket does not charge users for placing bets, but will charge a small transaction fee on winning trades.

Polymarket's tech: behind the scenes

Polymarket is built on an Ethereum layer 2 blockchain Polygon. This allows it to process transactions and handle contract execution quickly and efficiently. As a decentralized prediction market platform using a decentralized network, all of Polymarket’s data is also transparent and available to read via Polygon blockchain explorers.

Polymarket relies on smart contracts, the contents of which can vary widely; they may include binary options (where an outcome is either true or false), or more complex derivatives based on multiple potential results. Price formation happens through supply and demand as traders react to new information about an event's likelihood.

Finally, Polymarket also uses a verification oracle called UMA. This decentralized oracle relies on verifiers that follow strict guidelines and participate in incentivization mechanisms built to guarantee their integrity.

Polymarket vs regular odds: What’s the difference?

Polymarket’s UMA oracle has an incentivization scheme which means that participants are rewarded for providing the correct answer unlike with traditional polls. With a decentralized prediction market, cheating the system to influence the odds would cost money—money most aren't willing to spend. Polymarket’s decentralized prediction market is a much more trustless option as it leverages secure and decentralized crypto network Polygon.

Plus, unlike traditional odds, polymarket tracks real time data and sentiment —there’s no lag or days left waiting while pollsters publish data. With polymarket, everything is instant.

What was polymarket to do with the US election?

Polymarket gained huge popularity in the run up and aftermath of the 2024 US election. While many traditional prediction markets and financial media companies had initially mocked the accuracy of the crypto platform, Polymarket ended up having one of the most consistently accurate predictions of the final results of the election.

How accurate is Polymarket?

Like with all prediction markets, Polymarket is rarely completely accurate. However, since it uses real-time data and offers incentives for correct answers, its infrastructure allows for much fairer and accurate odds than traditional prediction markets or polling systems.

How reliable is polymarket?

Polymarket is a decentralized platform, meaning it relies on a series of smart contracts which its users are free to interact with via the platform. This means that the funds you use on polymarket smart contracts are secure, as long as the contract doesn’t include bugs or mistakes. Plus, buying or selling shares doesn't involve a middle man: you don't have to wait for Polymarket staff to process your transaction, it's all automated by the system. So far, polymarket contracts have proved to be reliable, but it’s always good to verify a smart contract before interacting with it nonetheless.

Where is polymarket available?

Polymarket is available in most countries around the world. However, it is not available in the US and may soon be banned in France.

Why is polymarket not available in the US?

Polymarket ceased operations inn the US in 2022 after failing to register with the Commodity Futures Trading Commission (CFTC) and having to pay $1.4 million fine to settle the case.

How to bet on Polymarket

To bet on Polymarket you will need 2 things: a web3 wallet and some USDC.

Once you’re ready, head on over to Polymarket, connect to your web3 wallet, and choose what you want to bet on the outcome of!

How onchain prediction markets are changing the game

Recent statistics show significant activity on these platforms; for example, Polymarket saw over $508 million wagered during major events like the U.S. presidential elections (NBC News). This highlights not only user engagement but also market liquidity across different types of predictions available on these platforms.

Blockchain technology has become a game-changer for prediction markets by providing a decentralized system that improves transparency and security—participants can verify transactions and protect themselves against manipulation or fraud. Smart contracts and oracles allow for automation —removing the need for middlemen and creating a fairer, more accurate system.

Polymarket FAQ

Who owns Polymarket?

Polymarket was created by Shayne Coplan, but it has also received investment from Peter Thiel and Ethereum co-founder Vitalik Buterin.

Does Polymarket require KYC?

Polymarket is a decentralized prediction market that works on a permissionless layer 2 blockchain Polygon. That means you don't need to KYC to use Polymarket: all you have to do is connect your web3 wallet and get going. However, if you want to buy USDC, typically you will have to KYC on a centralized exchange.

How much are Polymarket fees?

Polymarket does not charge users for placing bets, but will charge a small transaction fee on winning trades.