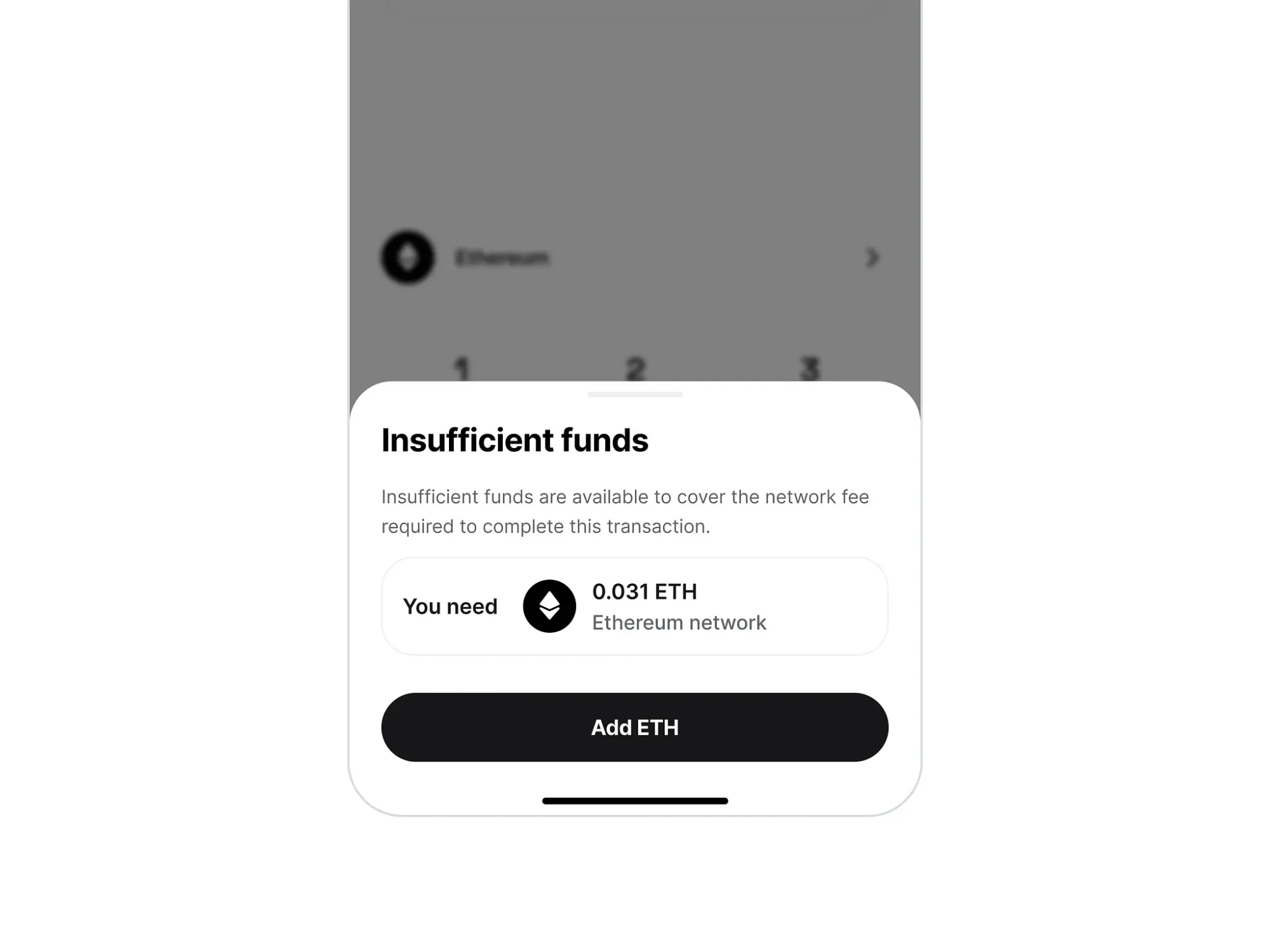

"Insufficient Funds" errors are killing your apps growth.

"Insufficient funds." Two words that have become crypto's most frustrating user experience. You know you have money, just not in the exact token on the exact chain that the app demands. What follows is a familiar dance of despair: switching between apps, hunting for bridges, calculating exchange rates, and hoping you end up with the right amount after gas fees and slippage.

It's a problem so common that we've normalized telling users to "go bridge your tokens" as if leaving the app mid-transaction is acceptable UX. But what if insufficient funds errors simply disappeared?

That's exactly what we're building with Universal Bridge, transforming one of crypto's biggest barriers into seamless, automatic fund sourcing that works across any chain, any token.

The Hidden Cost of Broken Money

Insufficient funds errors don't just frustrate users, they fundamentally break the promise of crypto as programmable money. In traditional payments, your bank account, credit cards, and payment apps work together seamlessly. You don't get declined because the merchant only accepts "Visa from Account #4" while you're trying to pay with "Mastercard from Account #7."

Yet in crypto, we've built exactly this fragmented experience. Apps demand specific tokens on specific chains, forcing users to maintain perfectly allocated portfolios across dozens of networks. The cognitive overhead is massive:

- Remembering which tokens you hold where

- Calculating if you have enough after gas and slippage

- Finding the right bridge for each chain pair

- Estimating how long transfers will take

- Managing multiple pending transactions across chains

This complexity doesn't scale to mainstream adoption. Normal users shouldn't need PhD-level knowledge of bridge mechanics to buy an NFT or use a prediction market.

When Money Becomes Inaccessible Money

The insufficient funds problem reveals a deeper issue: artificial scarcity in digital assets. You might have $1,000 worth of crypto across various chains and tokens, but still can't complete a $50 transaction because it's not in the exact form the app expects.

This creates scenarios that would be absurd in traditional finance:

- Having $500 in ETH on mainnet but unable to mint a $10 NFT on Base

- Owning thousands in stablecoins but getting blocked from a $100 purchase because it requires a different stablecoin

- Holding governance tokens worth $2,000 but unable to claim $5 worth of rewards on another chain

Each insufficient funds error represents a moment where crypto fails its users. Instead of enabling frictionless value transfer, we've created a system with more barriers than traditional finance.

Tired of insufficient funds errors? Try Universal Bridge and experience automatic fund sourcing across any chain.

The Universal Bridge Solution: Smart Fund Sourcing

Universal Bridge eliminates insufficient funds errors by treating your entire crypto portfolio as one unified balance. When you need to complete a transaction, the system automatically:

- Scans your holdings across all major chains and tokens

- Calculates optimal routes through bridges and DEXs

- Executes conversions behind the scenes

- Delivers exact amounts to complete your transaction

This happens invisibly and automatically. From the user's perspective, the transaction simply works. Behind the scenes, Universal Bridge might:

- Bridge ETH from mainnet to Arbitrum

- Swap it for USDC on a DEX

- Route to the destination chain

- Complete the original transaction

The user never sees this complexity. They just see their intended action completed successfully.

Real-World Impact: From Friction to Flow

The difference is dramatic. Consider a user trying to participate in a prediction market that requires 100 USDC on Polygon, but they only have ETH on mainnet:

Traditional Experience:

- Discover insufficient funds error

- Leave the prediction market app

- Research Polygon bridges

- Navigate to bridge interface

- Calculate ETH to USDC conversion

- Add gas buffer for uncertainty

- Execute bridge transaction

- Wait 10-20 minutes for confirmation

- Return to prediction market

- Hope they bridged enough after gas costs

- Complete original transaction (maybe)

Universal Bridge Experience:

- Click to place bet

- Transaction completes

This transformation is already happening across the ecosystem. We've seen prediction markets where users can participate with any token they hold. Gaming apps where players use their existing holdings to buy in-game assets. NFT marketplaces where collectors aren't limited by which chain their funds happen to be on.

The result? Apps report significantly higher conversion rates and user retention when transaction friction disappears.

Beyond Individual Transactions: Systemic Benefits

Solving insufficient funds creates ripple effects throughout the crypto ecosystem:

For Users:

- Simplified portfolio management across chains

- Higher success rates for intended actions

- Reduced cognitive load and decision fatigue

- Access to opportunities regardless of fund location

For Apps:

- Higher conversion rates on user actions

- Reduced support burden from confused users

- Access to users' full crypto wealth, not just chain-specific balances

- Competitive advantage through superior UX

For the Ecosystem:

- Increased overall transaction volume

- Better capital efficiency across chains

- Reduced barriers to multi-chain app adoption

- More seamless onboarding for new users

Ready to eliminate transaction friction in your app? Add Universal Bridge with just a few lines of code.

The Technical Foundation: How It Works

Universal Bridge leverages the existing interoperability infrastructure that's already live across crypto. We integrate with:

- Major bridges like Across, Relay, LayerZero, and Hyperlane

- Leading DEXs for optimal token swaps

- Cross-chain messaging protocols for coordination

- Gas optimization algorithms for cost efficiency

Rather than building yet another bridge, we've created an intelligent routing layer that selects the best path for each transaction. This approach provides:

- Maximum coverage: Access to virtually every token on every major chain

- Optimal pricing: Competition between routes ensures best rates

- High reliability: Redundancy across multiple protocols

- Future-proof design: New bridges and chains integrate automatically

The system continuously learns and optimizes, becoming smarter with each transaction.

From Crypto Complexity to Internet Simplicity

The goal isn't just better crypto UX, it's making crypto disappear into the background of internet-native applications. When payments work seamlessly regardless of underlying complexity, developers can focus on building great products instead of managing user onboarding friction.

Imagine social apps where tipping creators works with any token. Gaming platforms where earning and spending happens naturally across multiple chains. E-commerce sites where crypto payments feel as simple as traditional cards. Creative platforms where supporting artists doesn't require thinking about which blockchain they're on.

This isn't a distant future, it's happening now. Apps that implement Universal Bridge report user experiences closer to web2 simplicity while maintaining crypto's unique benefits: true ownership, programmability, and global accessibility.

The Broader Vision: Money That Actually Works

Solving insufficient funds is about more than UX improvements, it's about fulfilling crypto's core promise. Digital money should be more flexible than physical money, not less. It should enable new possibilities, not create new barriers.

Universal Bridge represents a step toward that vision: money that flows as freely as information on the internet. Where value can move instantly between any applications, across any networks, in any denominations users prefer.

The infrastructure exists today. The bridges are live, the DEXs are liquid, the messaging protocols are robust. What's been missing is the abstraction layer that makes this power accessible to normal users and normal apps.

By eliminating insufficient funds errors, we're not just fixing a UX problem. We're removing one of the last major barriers between crypto and mainstream adoption. Because money that works everywhere, instantly, is money that can finally compete with traditional payments on user experience while delivering capabilities that traditional payments simply cannot match.

The future of onchain transactions isn't about better bridges or faster chains. It's about making the complexity invisible so users can focus on what they actually want to accomplish.